AUBURN UNIVERSITY, Ala. — While many Americans are still battling an increased cost of living, the economic outlook for 2024 shows promise, as markets in the United States continue to recover from the COVID-19 pandemic.

Inflation and economic growth

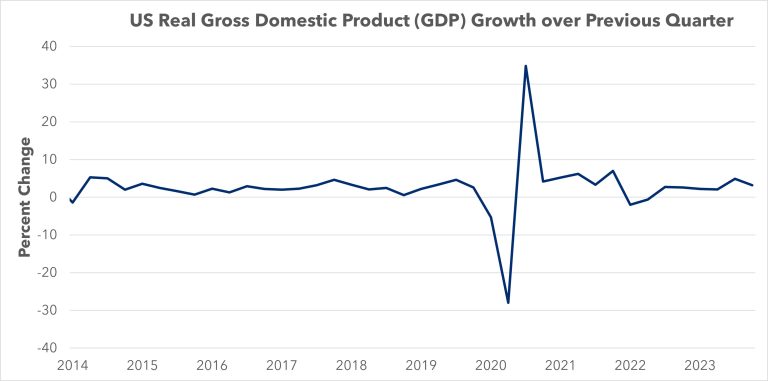

This figure shows real GDP growth — relative to the previous quarter — by quarter from 2014 to 2023. This data is from the Federal Reserve Economic Data.

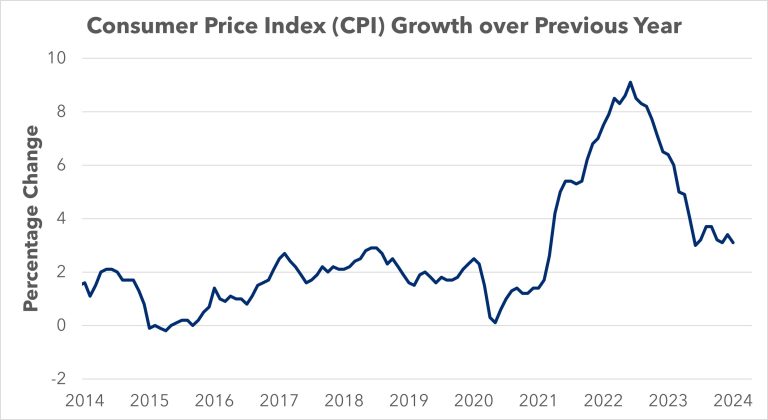

While inflation skyrocketed to 9.1% in June 2022, Wendiam Sawadgo, an Alabama Cooperative Extension System economist, said inflation is expected to get closer to pre-pandemic levels this year.

“Experts are predicting inflation to decrease to 2.4% in 2024,” Sawadgo said. “This is not quite to the Federal Reserve’s long-term inflation target of 2%. Before the pandemic, the inflation rate averaged 1.8% per year from 2010-2019.”

In addition to decreasing inflation, Sawadgo said the recent economic growth has been fairly good. The term used for economic growth is gross domestic product, better known as GDP. This is a measurement of the value of final goods and services during a certain time period. GDP rates can be expressed in two ways: nominal and real.

Rates measured in nominal values do not account for inflation, whereas real values do. In the two most-recent quarters, the real GDP growth rates were 3.3 and 4.9%. These show that the economy is growing after accounting for the value of the dollar.

Labor

This figure shows the change in the consumer price index (CPI) — relative to the previous year — by month from 2014 to 2023. This is also called the inflation rate. The data is from the U.S. Bureau of Labor Statistics.

Labor is also an area where some positive signs are showing. However, Sawadgo said it is important to look at the full picture related to labor.

“The unemployment rate is at 3.7% and reached the lowest mark in over 50 years in 2023,” he said. “However, the unemployment rate does not account for those who are not looking for a job. So, we also have to consider the labor force participation rate.”

The labor force participation rate is the percentage of civilians 16 years and older who are employed or who are unemployed and looking for work. This rate excludes people who are inmates of institutions — such as penal and mental facilities — and who are on active duty in the military.

While the unemployment rate was the lowest in decades, Sawadgo said the labor force participation rate has not returned to pre-pandemic levels. Before COVID-19, the rate was 63.3%. Once the pandemic hit, the rate fell sharply and has yet to recover fully, sitting at 62.5%.

Interest rates

In 2022, the Federal Reserve started raising the federal funds rate as a tactic to help reduce rising inflation. Sawadgo said interest rates went from an average of 3% in late 2021 to 6.9% as of February 2024.

“High interest rates — combined with a steep increase in house prices from 2020 and 2021 — have made it more expensive for people to buy a home,” Sawadgo said. “To make matters worse, the real median household income (accounting for inflation) has decreased the past couple of years because wage increases have not kept up with inflation.”

Because raising interest rates was done to combat inflation, as inflation levels continue to lower, interest rates are expected to follow. Sawadgo said he expects the Federal Reserve to start decreasing the federal funds rate in the coming months.

“We are still above the Federal Reserve’s target of 2% inflation, sitting at 3.1%, but things are headed in the right direction,” he said. “In relation to housing markets, the average interest rate on 30-year mortgages was 6.94% as of February 29, 2024. Analysts expect this rate to drop to about 6% by the end of the year.”

Helping with your financial needs

The economy is a complex creature, with many moving parts. Sometimes, it is hard to fully understand how it all works. In the news article, “Extension Economist Provides Guide to Understanding the Economy,” Sawadgo discusses some common economic misconceptions and what metrics consumers can look to when they have questions.

Whether you are a homeowner, farmer, student or someone in between, Alabama Extension has the experts to help you with your financial needs. From setting financial goals to building a better budget, help is available by visiting the Extension website, www.aces.edu, or contacting your county Extension office.