CULLMAN, Ala. – The Cullman City School Board on Monday held the first of two public hearings to discuss its proposed Fiscal Year (FY) 2021 budget, led by Chief Financial Officer James Brumley. Following are details and highlights from the budget, along with information from previous years for comparison.

Note: some of the personnel unit numbers came out with decimal points and not as whole numbers. Where these occurred, units were rounded down to the lower whole number.

Cullman City Primary School

Projected 2021 enrollment – 467

Personnel

- Teachers – 36

- Librarian – 1

- Counselor – 1

- Administrator – 1

- Non-Certified Support Personnel – 21

- 60 total

Proposed total foundation program budget – $2,805,468

East Elementary School

Projected 2021 enrollment – 602

Personnel

- Teachers – 35

- Librarian – 1

- Counselor – 1

- Administrators – 2

- Non-Certified Support Personnel – 15

- 54 total

Proposed total foundation program budget – $2,875,703

West Elementary School

Projected 2021 enrollment – 598

Personnel

- Teachers – 40

- Librarian – 1

- Counselor – 1

- Administrators – 2

- Non-Certified Support Personnel – 19

- 64 total

Proposed total foundation program budget – $2,901,952

Cullman Middle School

Projected 2021 enrollment – 522

Personnel

- Teachers – 29

- Librarian – 1

- Counselor – 1

- Administrator – 2

- Non-Certified Support Personnel – 15

- 49 total

Proposed total foundation program budget – $2,358,756

Cullman High School

Projected 2021 enrollment – 979

Personnel

- Teachers – 57

- Librarian – 1

- Counselor – 3

- Administrators – 4

- Non-Certified Support Personnel – 24

- 89 total

Proposed total foundation program budget – $4,505,250

Board of Education

Proposed total foundation program budget – $104,638 ($80,000 salaries, $23,729 benefits, plus other expenses)

System totals

Projected 2021 enrollment – 3,168

Personnel

- Teachers – 201

- Librarians – 5

- Counselors – 7

- Administrators – 15

- Non-Certified Support Personnel – 131

- 360 total

Proposed total foundation program budget – $19,554,904

- Salaries – $10,835,916

- Benefits – $4,235,149

- Teacher supplies and materials – $121,260

- Technology – $70,736

- Library Enhancement – $31,874

- Professional Development – $20,210

- Textbooks – $236,622

For comparison: 2015/16 budget/personnel

2015/16 enrollment – 3122 . . . . . . . . . . . . . . . . . . (15/16 to 20/21: +46 increase)

Personnel

- Teachers – 197 . . . . . . . . . . . . . . . . . . . . . . (15/16 to 20/21: +4 increase)

- Librarians – 5 . . . . . . . . . . . . . . . . . . . . . . . (15/16 to 20/21: same)

- Counselors – 7 . . . . . . . . . . . . . . . . . . . . . . (15/16 to 20/21: same)

- Administrators – 14 . . . . . . . . . . . . . . . . . . (15/16 to 20/21: -1 decrease)

- Non-Certified Support Personnel – 126 . (15/16 to 20/21: -5 decrease)

- 349 total . . . . . . . . . . . . . . . . . . . . . . . . . . (15/16 to 20/21: +11 increase)

Proposed total foundation program budget – $16,346,577 (15/16 to 20/21: +3,208,327 increase)

Comparing the FY 2003, FY 2016 and current year 2020/21 budgets

2003

General Fund revenues – not available

Total revenues – $18,323,857.06

General Fund expenditures – not available

Total expenditures – $17,847,408.62

Ending fund balance, Sept. 30, 2003 – $5,417,775.93

2016

General Fund revenues – $23,727,843

Total revenues – $29,832,607

General Fund expenditures – $22,325,602.23

Total expenditures – $29,412,224.64

Ending fund balance, Sept. 30, 2016 – $7,734,269.58 ($5,116,040.56 General Fund)

2020/21 (projected)

General Fund revenues – $28,716,700.79

Total revenues – $35,138,891.65

General Fund expenditures – $27,605,985.73

Total expenditures – $35,495,287.85

Projected ending fund balance, Sept. 30, 2021 – $22,765,422.60 ($7,500,216.11 General Fund)

About the 2021 budget

The budget proposal included the following descriptions and information:

The General Fund is the primary operating fund of the school district. This fund includes the majority of state and local revenues and related expenditures, except for those required to be accounted for in a different fund type.

The primary source of state revenues is derived from the State of Alabama Education Trust Fund. The Alabama State Legislature approves the Education Trust Fund Budget each year. The State Education Trust Fund receives the majority of its funding from sales and income tax, which are more susceptible to changes in economic conditions.

Cullman City Schools state allocations through the Foundation Program increased by $190,939 for FY2021 when compared to FY2020. This increase is attributed to a rise in state funded certified units equal to one and an increase of Other Current Expense by the Legislature. There was no state raise given by the Legislature for FY2021.

In order to receive funding from the State Education Trust Fund through the Foundation Program, all school systems must provide a 10.0 mill property tax equivalency match. Cullman City Schools match to participate in the Foundation Program is $3,413,518 for the fiscal year ending September 30, 2021, a decrease of $6,761.

Budgeted revenues and other financing sources in the General Fund decreased by $493,718.06.16 for FY2021. This decrease is due to the net of increases and decreases in State Allocations and local revenues. While local revenues did increase for FY2021 the overall State Allocations decreased. The Advancement & Technology allocation went away for FY2021 which was a loss of $759,020. These funds may come back but this is unknown until the Legislature meets in the Spring. The increase in budget local revenue is derived primarily from the increase in sales tax appropriations and ad valorem. The City of Cullman appropriates one cent of sales tax to Cullman City Schools, which reflects $3.5 million in revenue for FY2021. Additionally, local revenue budgets increased slightly in county wide property and sales taxes that are shared with other county districts on the basis of enrollment. As Cullman’s student enrollment has increased relative to the county, so has its proportionate share of these revenues.

Budget General Fund expenditures and other fund uses increased by $99,142.94 for FY 2021 primarily in instructional services. The school district continues to transfer $100,000 to the capital projects fund for roofing needs and turf replacement. The $450,000 that was transferred to the building projects fund for building projects in previous years is now used as debt service on the $11.3 bond issue that was issued in FY2020.

The General Fund expenditures exceed revenues by $462,933.89 for FY2021 which was expected. This is due to the net of the following:

- State Transportation Fleet Renewal . . . . . . . . . . . $7,738.00

- Surplus in Local Fund Source . . . . . . . . . . . . . . . . $234,328.11

- Advancement & Technology Funds Remaining . . ($705,000.00) negative, see below

The Advancement & Technology Funds were received in previous years but will be expended in FY2021. Fleet Renewal funds are new for the district and will continue to rollover each year. The General Fund projected ending fund balance as of September 30, 2021 is $7,500,216. This represents 25% of expenditures and approximately 3.0 months of operations in the General Fund. Local boards of education are required by act of the Alabama State Legislature to develop a plan to establish and maintain a minimum reserve fund equal to one month’s operating expenses. The Board of Education has established a goal of a three-month operating reserve.

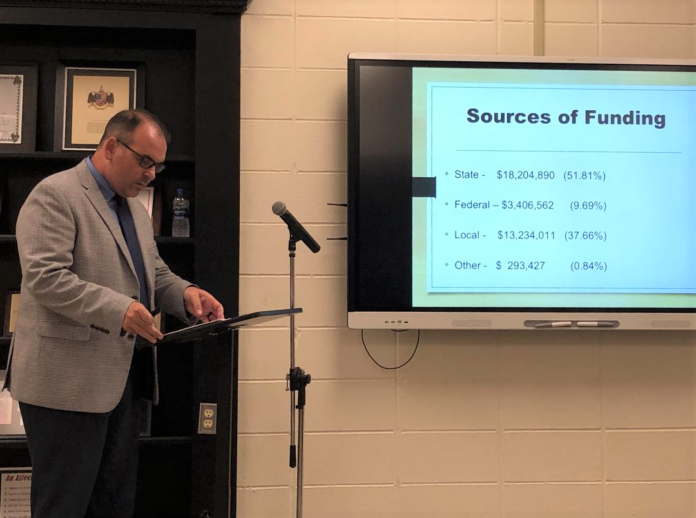

Proposed FY 2021 budget

The numbers here represent totals that are broken down in budget documents by fund type into General, Special Revenue, Debt Service, Capital Projects, Fiduciary Expendable Trust and Total (presented here)

Projected Revenues

State Revenues . . . . . . . . . . . . . . . . . . . . $18,204,890.79

Federal Revenues . . . . . . . . . . . . . . . . . . $3,406,562.86

Local Revenues . . . . . . . . . . . . . . . . . . . . $13,234,011.00

Other Revenues . . . . . . . . . . . . . . . . . . . $293,427.00

Total Revenues . . . . . . . . . . . . . . . . . . . . $35,138,891.65

Projected Expenditures

Instructional Services . . . . . . . . . . . . . . . $19,926,605.01

Instructional Support Services . . . . . . . . $4,804,849.06

Operations and Maintenance . . . . . . . . . $3,041,614.02

Auxiliary Services . . . . . . . . . . . . . . . . . . . $1,886,160.07

General Administrative Services . . . . . . . $1,647,673.71

Capital Outlay . . . . . . . . . . . . . . . . . . . . . $705,000.00

Debt Services . . . . . . . . . . . . . . . . . . . . . . $1,930,398.26

Other Expenditures . . . . . . . . . . . . . . . . . $1,552,987.72

Total Expenditures . . . . . . . . . . . . . . . . . . $35,495,287.85

Beginning Fund Balance, Oct. 1, 2020 . . $22,925,343.80

Ending Fund Balance, Sep. 30, 2021 . . . $22,765,422.60

The question of local funding

As local support for education, especially education infrastructure projects, has been a big issue in this election, The Tribune looked at local funding in the proposed budget, comparing it also to the 2015-16 budget, with brief views of other recent budget totals.

Local fund sources include the City’s 10-mill education ad valorem tax, 1-cent city education sales tax, a portion of countywide property and sales taxes, TVA revenues, out-of-district students, occasional funding or in-kind contributions from the City such as the annual School Resource Officer program and this year’s repaving of the Cullman High School parking lot, in addition to numerous smaller sources.

FY 2003 budget

Total local revenues to budget – $5,985,664.43

FY 2016 budget

Local revenues to General Fund – $9,578,860

Total local revenues to budget – $11,165,704

City of Cullman funding in FY 2016 included:

- $6,726,572 in sales and property taxes

- $108,989 payments in lieu

- $100,000 in in-kind services

- $6,935,561 total funding

FY 2017

Total City funding – $7,252,932

FY 2018

Total City funding – $7,370,135

FY 2019 – information not available

FY2020 – information not available

FY 2021 proposed budget

Local revenues to General Fund – $11,327,402

Total local revenues to budget – $13,234,011

Details on City funding not available

According to the proposed budget, FY 2021 will include a $6,761 decrease in revenues from the City 10-mill tax. The budget document, though, also says that overall local revenues will increase, and, “The increase in budget local revenue is derived primarily from the increase in sales tax appropriations and ad valorem.”

The Cullman City School Board will hold a second budget hearing in the Central Office board room at 4:30 p.m. Sep. 14. The public is invited to attend.

Copyright 2020 Humble Roots, LLC. All Rights Reserved.