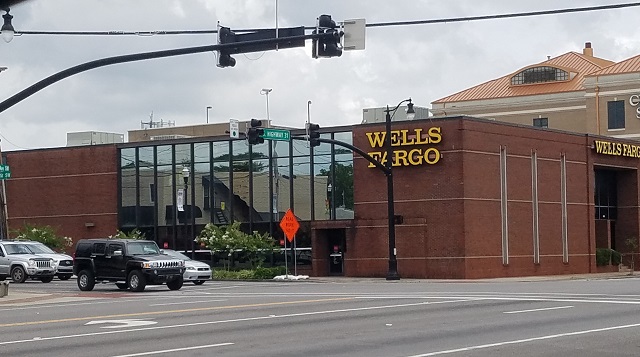

CULLMAN, Ala. – Both Regions Bank and Wells Fargo have announced upcoming consolidations of branch offices in Cullman, following a years-long national trend of local bank branch closures. Each institution currently has two branches in the city, and each will maintain one office. Regions will close its Catoma Ridge office along Alabama Highway 157 Aug. 23, consolidating local operations with its Second Avenue Southwest (U.S. Highway 31) location. Wells Fargo will close its Main Branch on Second Avenue Southwest Sept. 18, consolidating operations with its Town Square location near the intersection of U.S. Highway 31 and Cherokee Avenue.

Wells Fargo Assistant Vice President for Corporate Communications in Florida and the Southeast, Michael Gray, said in a statement:

“We continue to evaluate our branch network and base our distribution strategy on customer trends, market factors and economic changes, and as a result will close our Cullman Main Branch on September 18. It’s important to recognize that a physical branch is not the only way for us to serve our customers. While branches continue to be important in serving our customers’ needs, we’re finding that customers are often using our wide range of digital capabilities for many of their banking needs. We will continue to serve our customers at other branches – including our Town Square branch approximately two miles away – and through WellsFargo.com and our mobile banking app.”

Regions Corporate Communication spokesperson Mel Campbell issued this statement:

“As customer expectations for service and convenience have increased, Regions’ focus has been on making prudent investments – particularly in branch design, growth markets and digital services — to continuously improve customer service options and the customer experience. With this strategy, we also rely on a continuous and rigorous review of data, locations and policies to ensure the most efficient use of available resources, which recently identified opportunities to consolidate select branch locations based on traffic, new technology, volume, location of other branches, profitability, and other data.

“Regions will also work with the affected associates to find other positions within the company where possible.”

The change is nothing new for either corporation, following a national trend by banks to consolidate their operations and shrink their workforces. Birmingham-based Regions Bank had more than 2,100 local branches at its peak in 2007, before it began a series of closures which, according to Campbell, leaves the company with around 1,500 branches today. More than 150 branches have closed since 2016. The company is opening new branches, especially in larger cities, but at a pace far behind that of closures.

San Francisco-based Wells Fargo had more than 6,300 branches nationwide in 2012 but plans to reduce that number to below 5,000 by 2020, according to a report published by CNN.

The trend of bank branch closures dates back before 2010 but has accelerated since 2012. Between 2013 and 2018, banks across the country have closed approximately 7,500 branches, and according to a report cited by the Mercator Advisory Group in its PaymentsJournal, almost half of all large banks are participating in the trend. Local/community banks are faring better, with only about 15% closing branches.

Why are banks closing branches?

A March 2019 article in The Business Journal cited a study saying that, at current rates of change, branch office visits will drop 36% between 2017 and 2022. During the same period mobile transactions will increase by 121%, with smart devices becoming substantially more popular transaction tools than computers.

In a phone conversation, Campbell told The Tribune, “You think about how people are managing their finances using just an ATM, or whether they just use their phones, you know, having things like remote deposit where you can take a picture of a check, make a deposit with a phone. You don’t have to take a stack of checks to a branch like that. You can do that just whenever you feel like it, and a lot of other things people can do today that they couldn’t do in the past, but technology’s opened some doors to let people manage their money in different ways, and frankly, people are doing it.

“That is the yin and the yang of that. Think about everybody now that checks something on their phone, or pays for something with PayPal, or things that don’t really have anything to do with Regions. It’s just people have changed the way they manage their money over the last decade.”

Wells Fargo has publicly reported that increasing use of digital resources led to its decision to cut branches, but many in the financial field also point to legal troubles like the discovery of more than three million fake accounts in 2016 and 2017, which have cost the company more than $3 billion, and to the unauthorized enrollment of more than 500,000 customers in automatic bill pay programs.

Copyright 2019 Humble Roots, LLC. All Rights Reserved.